Medicaid Home Care Coordination

What is the NYS Medicaid Home Care Process

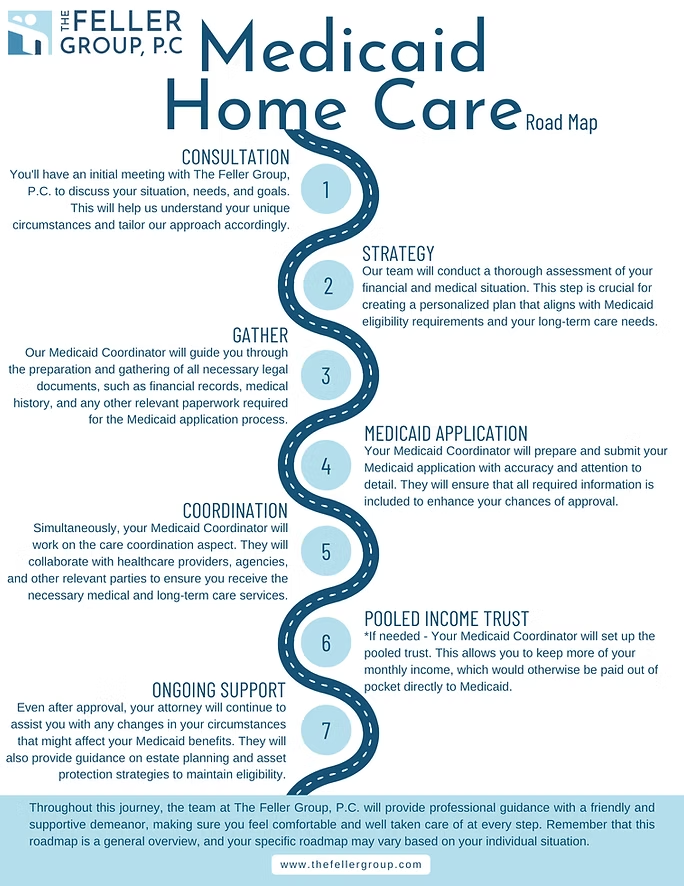

The Medicaid Application process is lengthy and complicated, with very strict deadlines and documentation requirements. Applications for Medicaid Home Care Benefits involve not just proof of financial eligibility but proof of medical need as well. The Medicaid Agency looks for reasons to deny applications, saving the government money and costing you tens of thousands of dollars for every month that goes by until the application is finally approved. For this reason, it is imperative that you hire experienced and dedicated Elder Law attorneys at The Feller Group, P.C.

We help our clients prepare all financial information and forms, required medical forms, and prepare the case to secure a maximum amount of home health aide hours. Our team has secured Medicaid nursing home and home care benefits for many clients like you with an unsurpassed success rate.

What Documents are Required for a Home Care Application?

What are Home Care Coordination Services

Your loved one has been determined financially eligible to receive Medicaid Home Care benefits. Now, what? How many hours of home health aide coverage will your loved one receive? Who does that evaluation? What is an MLTC? How are you supposed to know what to do next?

This is where The Feller Group, P.C. Medicaid Service Coordinator team comes in. Our experienced and highly skilled Medicaid Service Coordinator team will navigate the entire home health aide evaluation and services implementation process with you.

What does a Medicaid Services Coordinator Do?

The Feller Group, P.C. Medicaid Services Coordinator is an individual on our team who is responsible for helping our Clients with Medicaid access and coordinating their healthcare services after you are determined financially eligible to receive Medicaid Home Care benefits.

Our Coordinator will help those who are eligible for Medicaid by providing them with information about services available, assisting with paperwork related to the application process, and helping to coordinate and monitor the delivery of services. They also work to ensure that all services are being provided in accordance with the guidelines set by the Medicaid program.

Why Choose The Feller Group, P.C. Coordination Services?

Our Medicaid home care coordination services are designed to provide comprehensive support to seniors and individuals with disabilities. Our team doesn’t stop at the point of Medicaid financial approval like other elder law firms and Medicaid advisors. We bring you and your loved one over the finish line, holding your hand along the way.

In addition to providing unrivaled success in Medicaid Asset Protection planning, preparing and submitting Medicaid applications for community-based care, and establishing Pooled Income Trusts, our team administers exceptional Medicaid Home Care Coordination Services upon receiving financial approval for Medicaid benefits.

What our Medicaid Coordinator Services Include:

- Scheduling your initial assessment with New York State and reviewing the scoring process with you.

- Preparing as many as three Managed Long Term Care Plan (MLTC) intake applications.

- Scheduling nursing assessments during which the number of care hours are decided. If needed, Our Medicaid Service Coordinator can attend the assessment to act as your advocate to secure a maximum number of hours of home care.

- Review the nursing assessments with you and help you choose an MLTC as well as a home care agency that contracts with your MLTC.

- Assisting with alternative programs to obtain necessary services for your loved one, including the Consumer Directed Personal Assistance Program (CDPAP), the Nursing Home Transition and Diversion Waiver program.

What is a Medicaid Pooled Income Trust?

A pooled income trust is a special type of trust that allows individuals of any age to become financially eligible for Medicaid home care services, even if their income is higher than the Medicaid guidelines. There is no limit on how much money you can deposit into the pooled trust.

This trust works best for people who have excess monthly income above the Medicaid eligibility requirements. The pooled trust allows people to protect this portion of their income, which Medicaid would otherwise require to be “spent down on medical needs”.

The income deposited into the pooled trust is not considered when determining Medicaid eligibility each month, thereby maintaining your Medicaid services. Funds in the pooled trust are then used to pay living and other expenses, which allow you to remain in the community. Upon the beneficiary’s death, the remaining balance in the account is retained by the trust to support other people with disabilities.

View our Pooled Trust Brochure here.

Our Additional New York Medicaid Planning Services:

– Medicaid Asset Protection Trusts

– Promissory Note Planning

– Medicaid Fair Hearings and Appeals